Composable digital journeys with Neutrinos

End-to-end digital journeys are built from the composable building blocks and journey templates that Neutrinos provides.

Omni-Channel Solution

Dynamic Case Management

Agent Desktop Solution

NeuSprout Solution (Product Configuration)

Member Management Journey

Intelligent Document Processing

Quote & Buy

NeuSRM Solution (Lead Management)

Self Service Portals

IOT Enabled Servicing

AI-Based Social Analytics

End-to-End Channel Distribution

Appointment Management Solution

Claims FNOL & Servicing

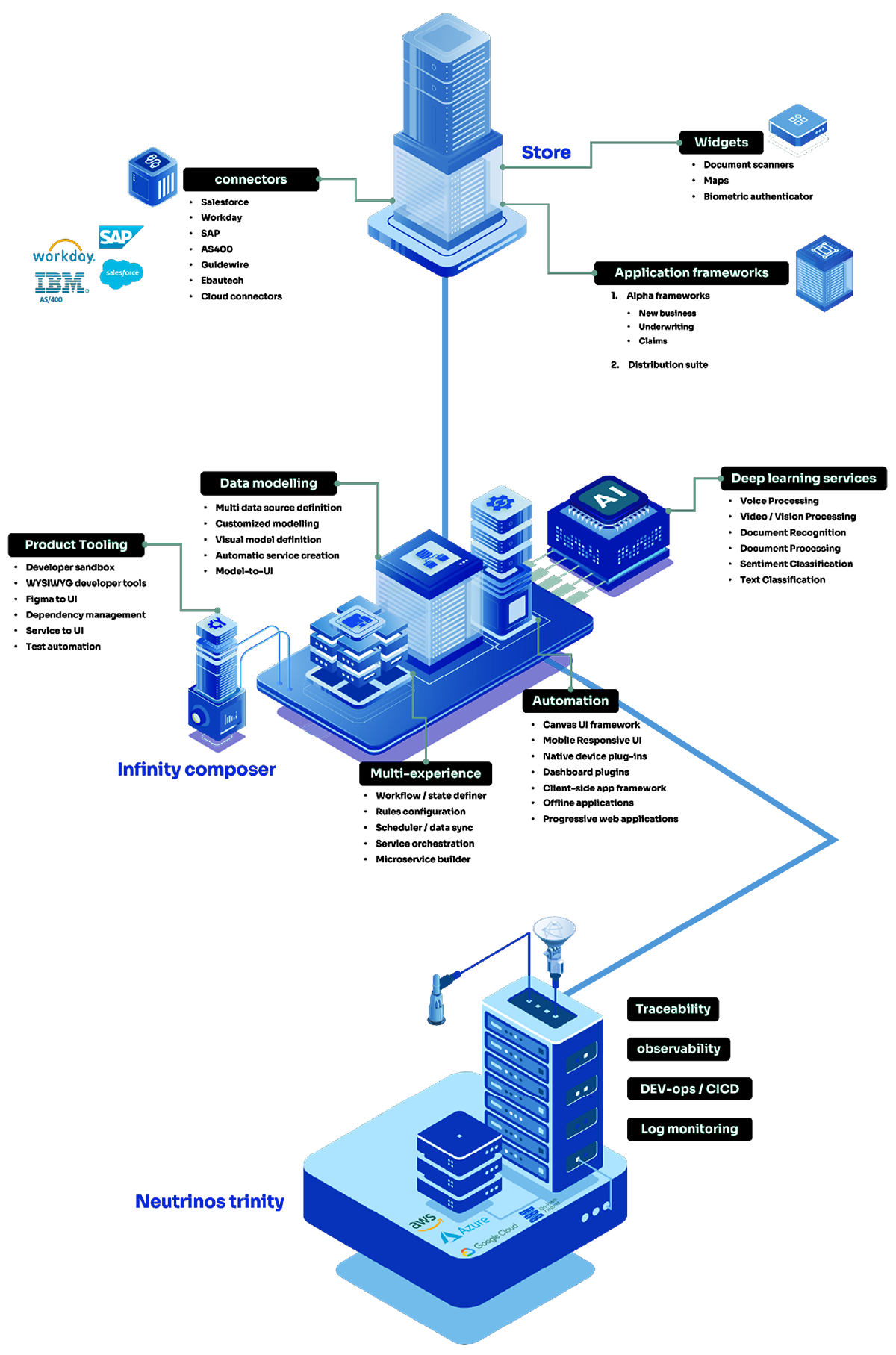

A closer look at the Neutrinos Platform

Foundational digital journey building blocks

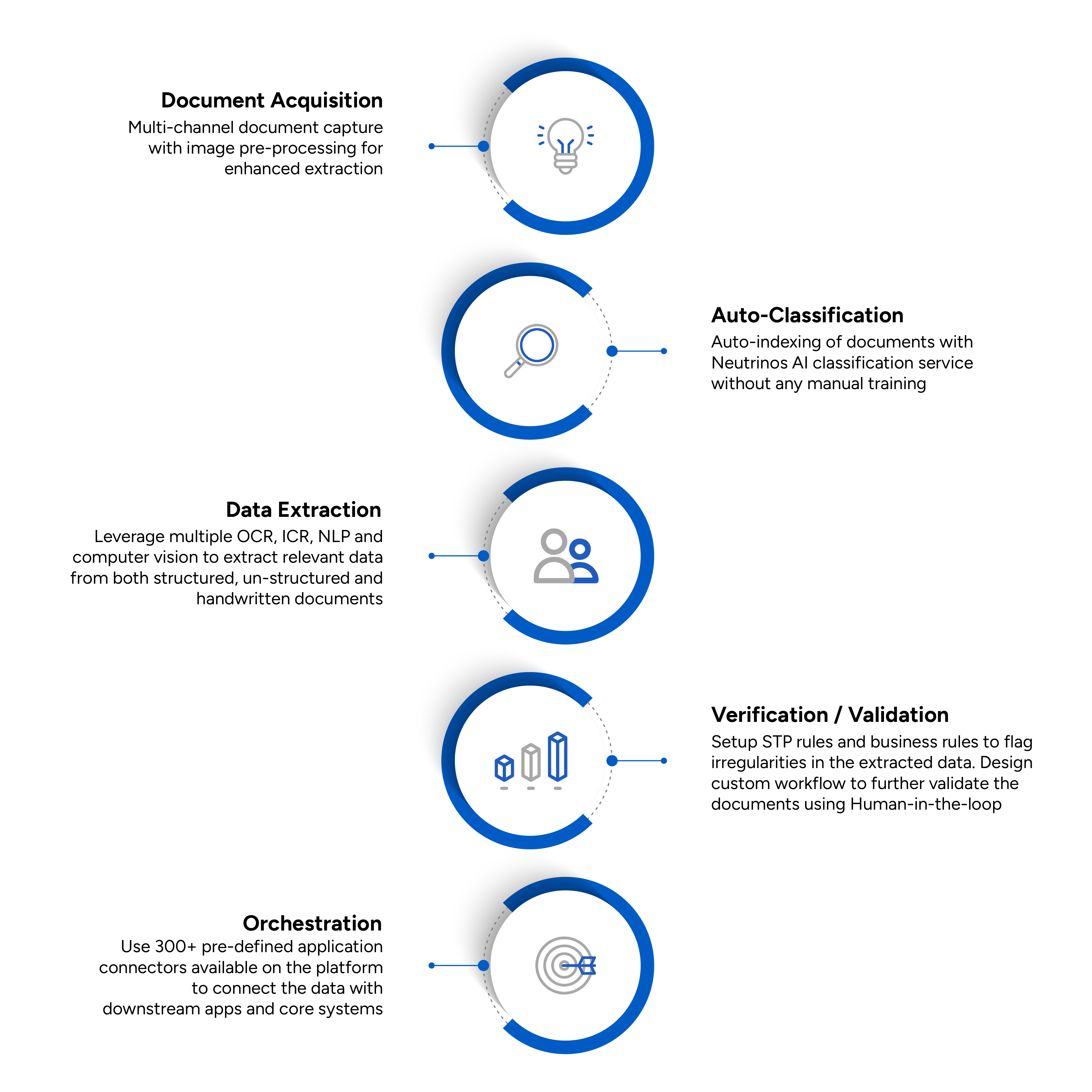

Intelligent Document Processing

Product Configurator

Case Manager

Neutrinos Composable Platform

From vision to victory

A sampling of insurance digital journey use cases built with Neutrinos.

MGA

Neutrinos offers Managing General Agents (MGAs) a comprehensive low code solution based on composable insurance journey building blocks that enables them to efficiently manage underwriting processes, automate policy administration, and gain real-time insights for effective risk management and enhanced profitability.

- Automate underwriting processes, accelerating policy issuance and renewals.

- Enhance operational efficiency and reduce costs through streamlined workflows and real-time analytics.

- Expand market reach by integrating with various distribution channels, offering tailored insurance products.

- Improve risk management with advanced analytics and predictive modeling for informed underwriting decisions.

Insurer

Neutrinos empowers insurers to rapidly develop and deploy innovative digital solutions that enhance customer experience, streamline operations, and drive business growth. With Neutrinos’ low code platform and an industry-leading collection of digital journey building blocks, insurers can:

- Streamline underwriting processes, improving efficiency and reducing manual effort.

- Enhance customer experience through self-service portals and personalized quotes.

- Gain insights into risk management with advanced analytics and real-time visibility.

- Drive innovation and agility with rapid prototyping and deployment of insurance solutions.

Broker

Neutrinos enables insurance brokers to streamline customer interactions, automate quoting and policy issuance, and enhance collaboration with insurers, resulting in improved efficiency, customer satisfaction, and business performance. With Neutrinos’ cutting-edge platform, brokers can:

- Streamline operations by automating quoting and policy issuance processes.

- Enhance customer interactions and satisfaction with self-service portals and personalized quotes.

- Expand market competitiveness by rapidly growing carrier network and offering comprehensive solutions.

- Gain real-time insights into performance and risk management for data-driven decision-making.

Aggregator

Neutrinos equips aggregators to integrate and aggregate data from multiple insurers, streamline the quote comparison process, and deliver personalized insurance offerings to customers, enhancing their value proposition and market competitiveness. With Neutrinos’ insurance digitalization platform, aggregators can:

- Simplify the quote comparison process by through intelligent, rules-driven quote generation and illustration.

- Provide personalized insurance offerings to customers based on their needs.

- Deliver a seamless customer experience with simplified access to comprehensive options.

- Stay competitive by rapidly integrating new insurers and expanding their offerings.

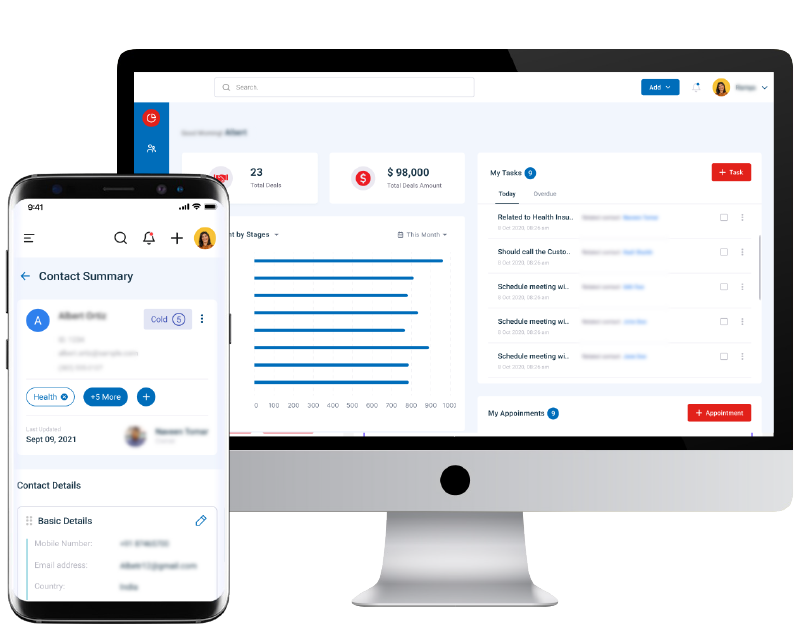

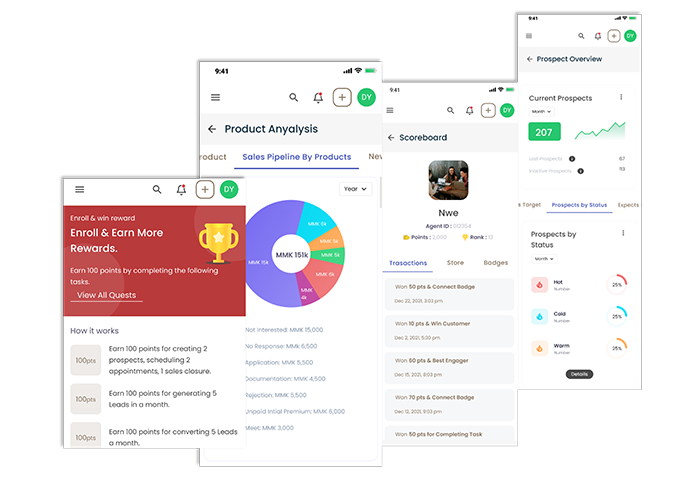

Lead Management System (SG)

An application that provides insurance agents with everything they need to close sales fast and effectively. The Lead Management System provides agents with leads assignment data, ability to capture notes, schedule appointments, and take leads through a well-defined lifecycle.

50% higher conversion rate

60% more leads managed per agent

10x reduction in lead turnaround time

1st MVP Roll-out in 3 months

Agent Productivity, Performance Tracking and Gamification

Agent activity and performance module provides in-depth analysis of current leads, sales statistics and comparative KPIs to help agents plan strategies and process improvements. The capability can be seamlessly integrated into the lead management system (agent workbench) for a single window productivity solution.

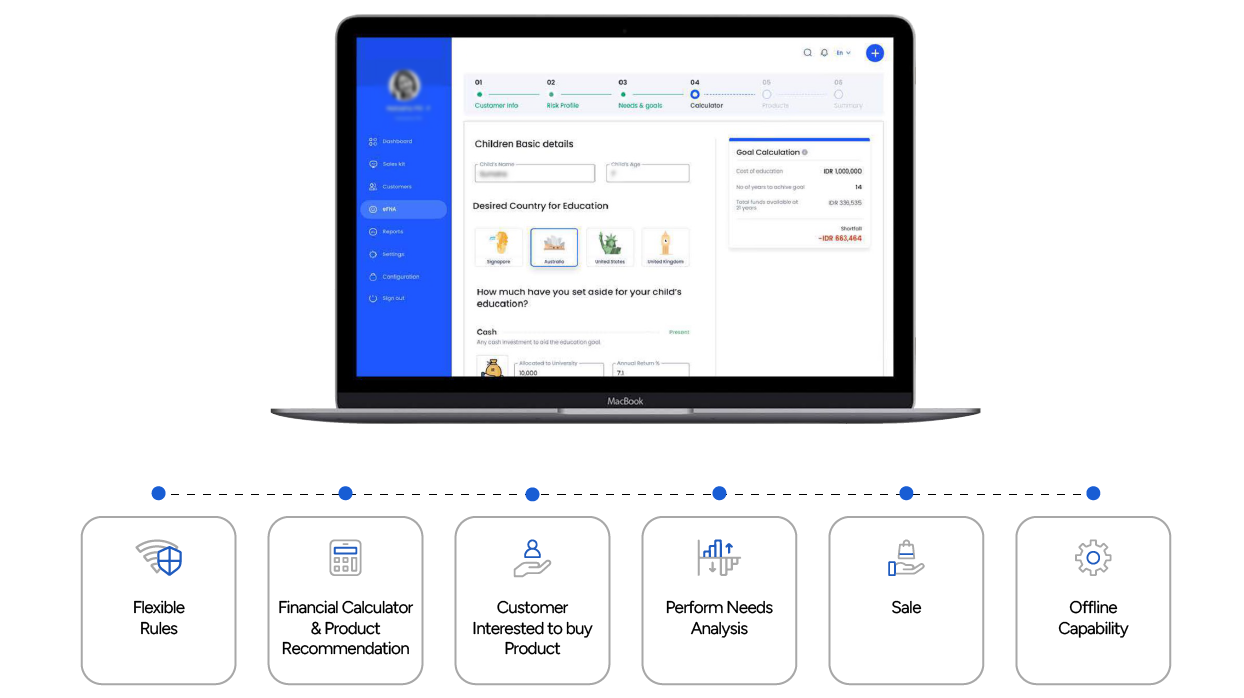

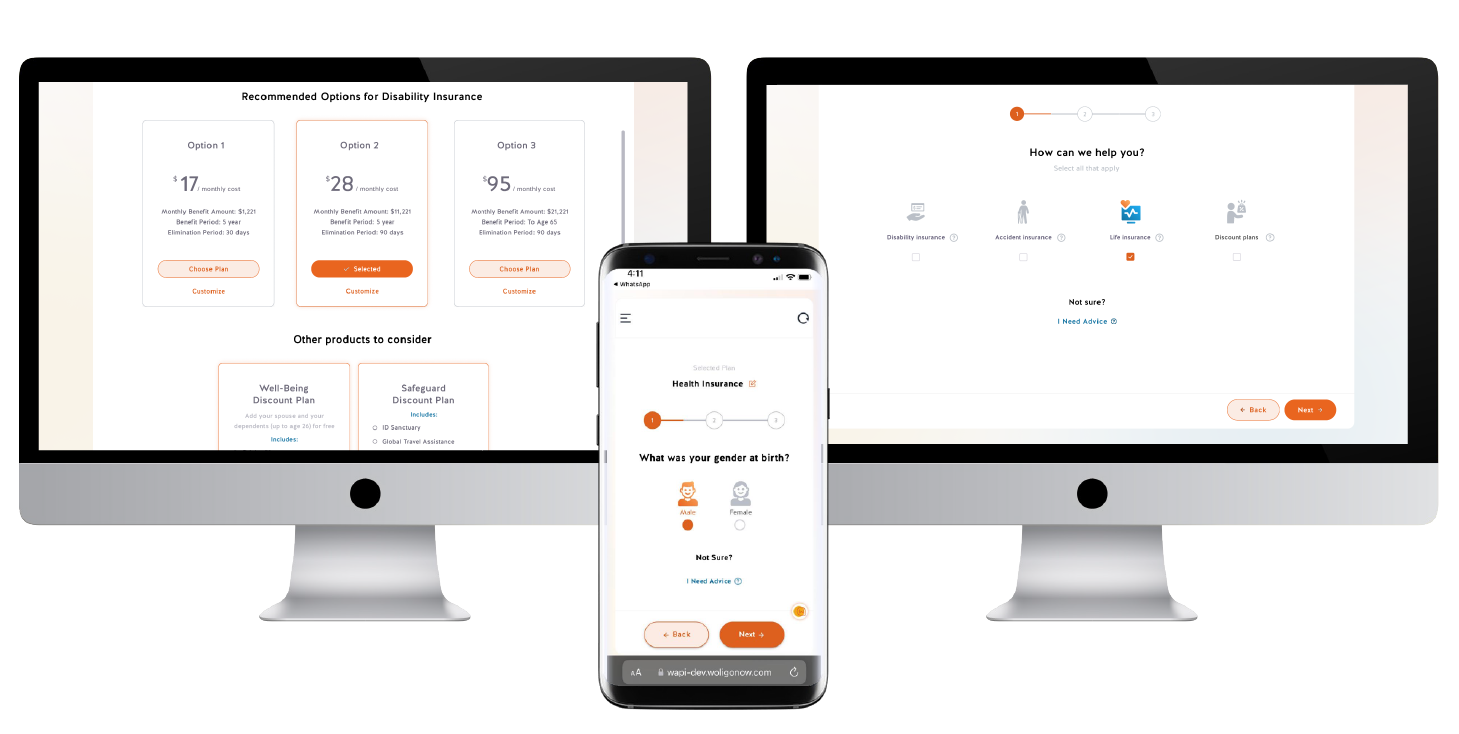

User-Friendly Financial Needs Analysis Tool for Agents (SG)

The FNA application is backed by the intuitive journey of a customer based on their demography, with permutation & combination of multiple rules. It is available in offline mode that makes it easier for agents to use the application while offline. The UI & UX becomes the most important part for a customer & agent who will find it interesting and interactive at the same time to perform the FNA.

25% Higher conversion rate

45% faster conversion

80% Higher customer satisfaction

1st MVP Roll-out in 3 months

Agent Productivity, Performance Tracking and Gamification

Agent activity and performance module provides in-depth analysis of current leads, sales statistics and comparative KPIs to help agents plan strategies and process improvements. The capability can be seamlessly integrated into the lead management system (agent workbench) for a single window productivity solution.

Aggregator Portal (US) For Multiple Risk Lines

A highly interactive aggregator portal solution that provides personalized, conversational product recommendation based on the customer’s life stage and interests. It is a chatbot assisted selling system that completes the sales journey in a completely straight-through manner including payment processing. The solution orchestrates quote generation and policy issuance across a diverse carrier network, and enables highly customized experiences and journeys based on the product type.

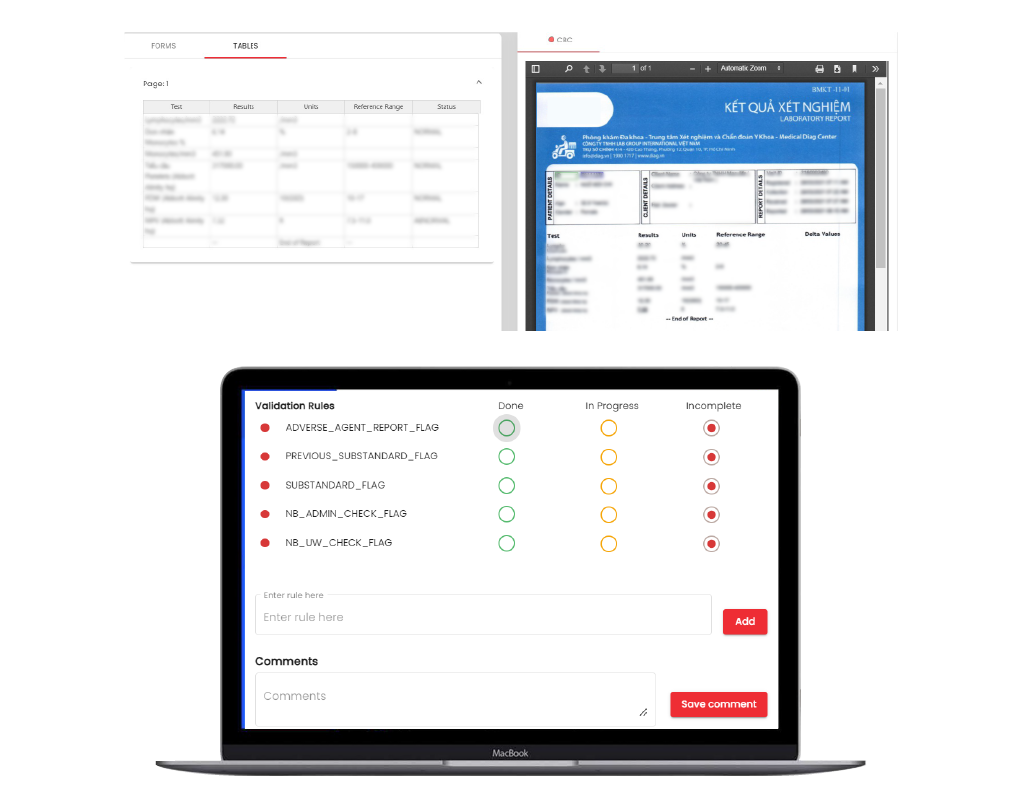

New Business Application Intake and Verification

The Intelligent Document Processing module enables automation of data entry from unstructured data such as paper scans, emails etc. It can automatically identify and classify documents, and extract data from key fields without being specifically trained for field positions. It also supports sensitive data redaction and data verification – thereby eliminating manual activity.

80% STP enabled

95% data extraction accuracy

70% Operational costs

Can be rolled out in as little as 2-3 days

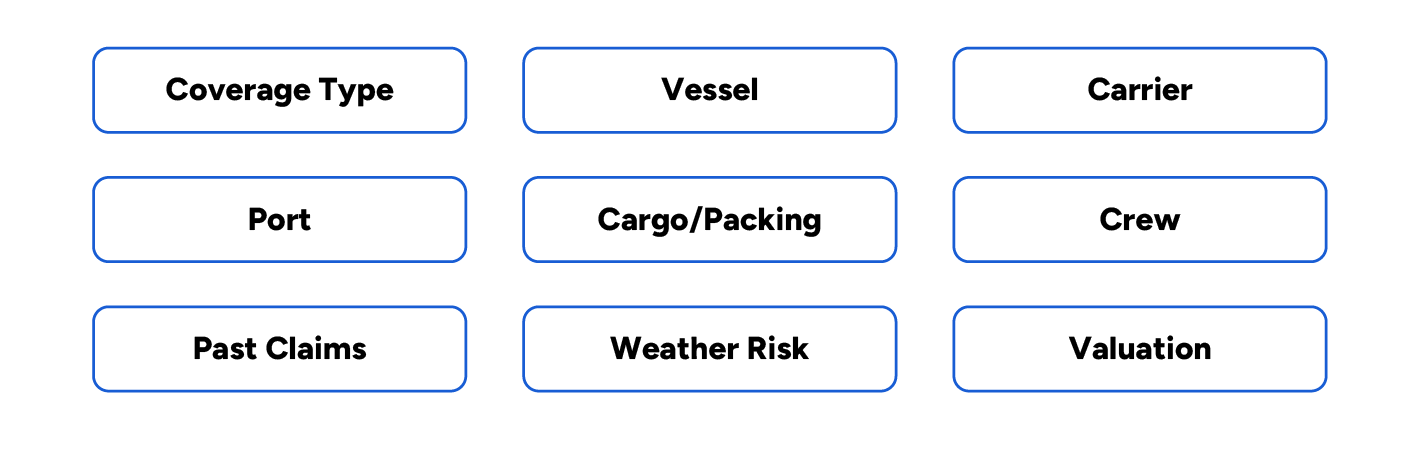

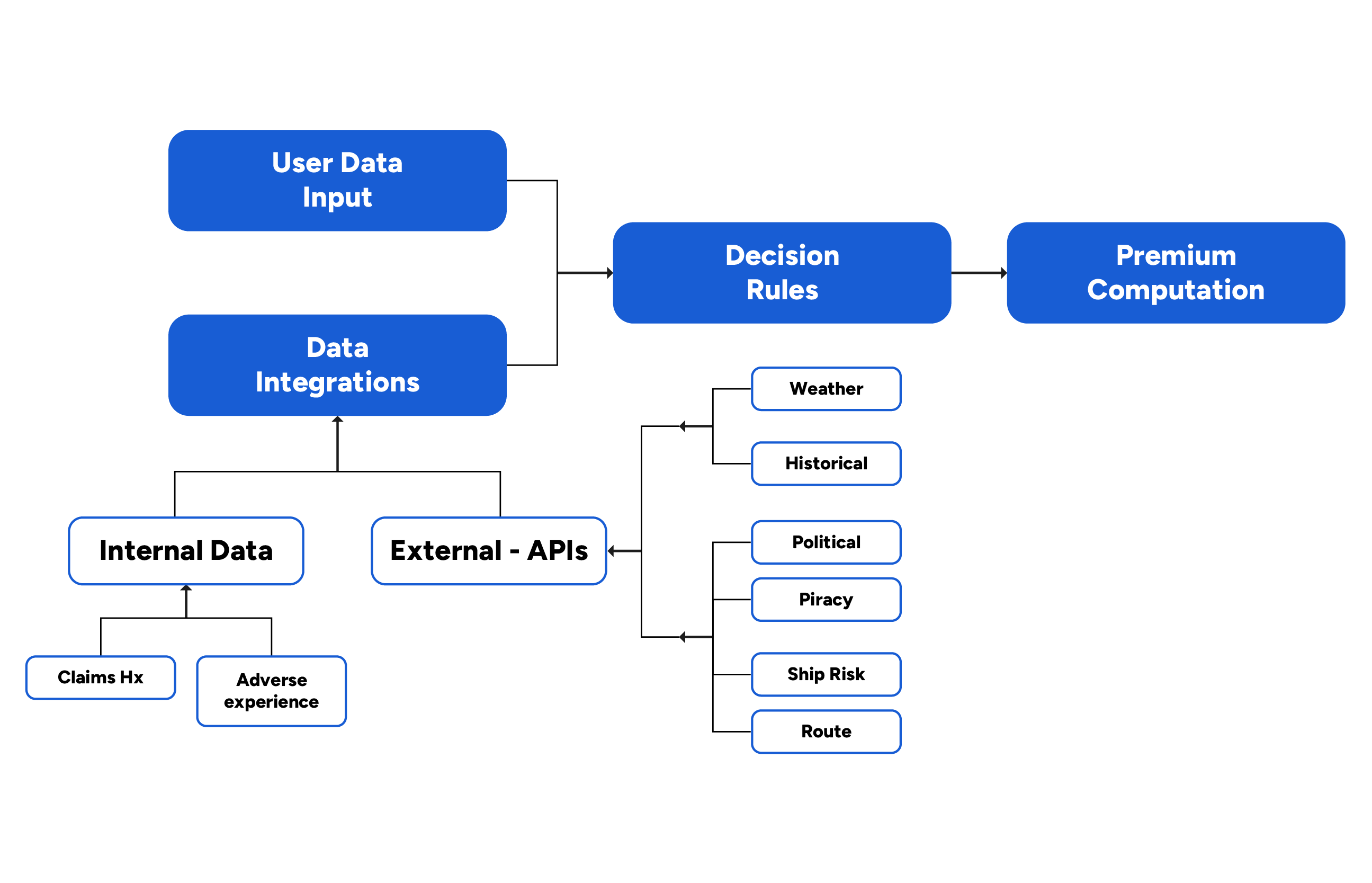

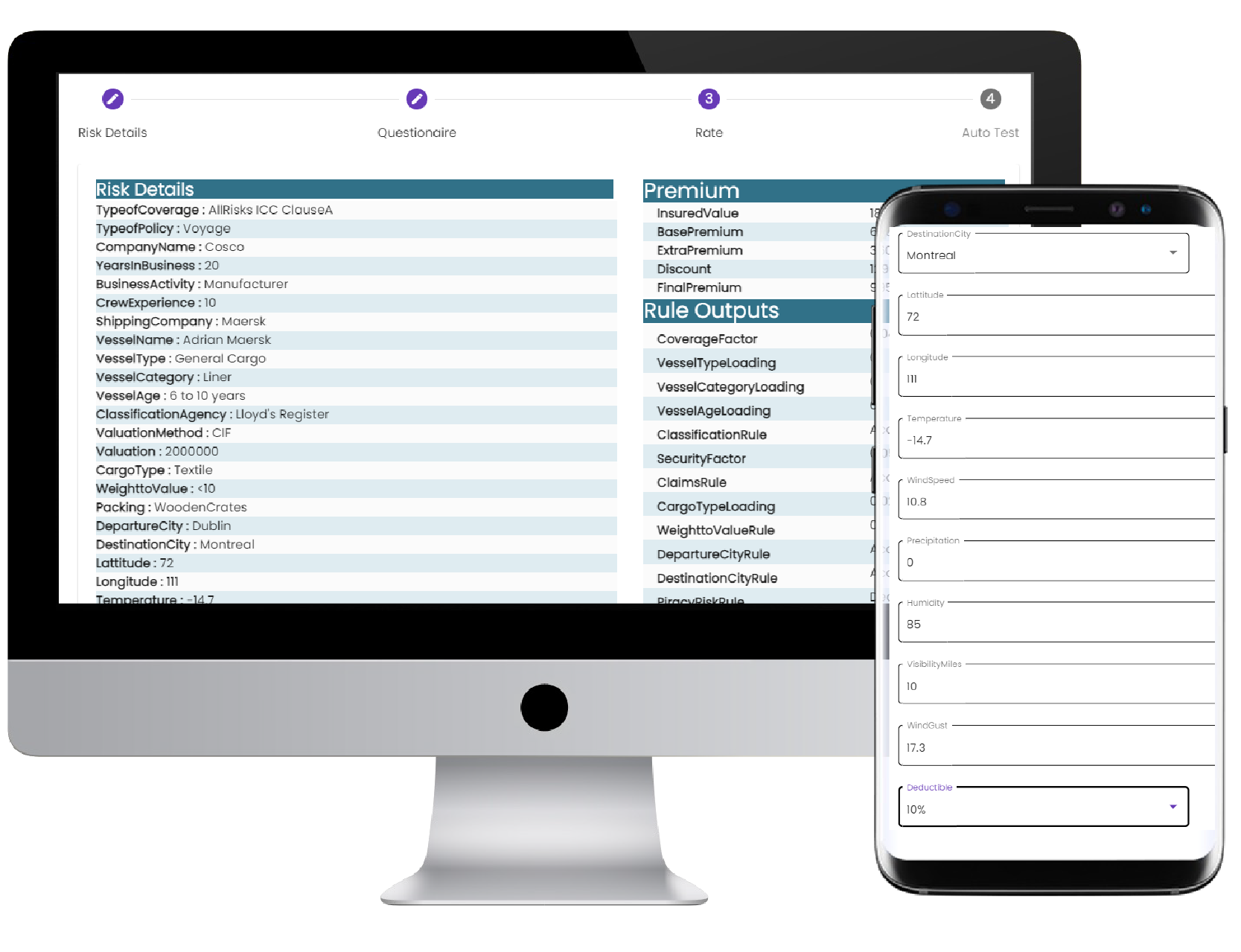

Auto Underwriting – Marine (Neusprout)

Marine Cargo Quotation and Auto Underwriting Configuration use case. Neusprout enables setting up complex Risk and Peril evaluation including real-time weather assessment based on maritime weather maps. The configuration not only provides the quotation, but also a detailed risk assessment including referrals to relevant underwriting experts for further action.

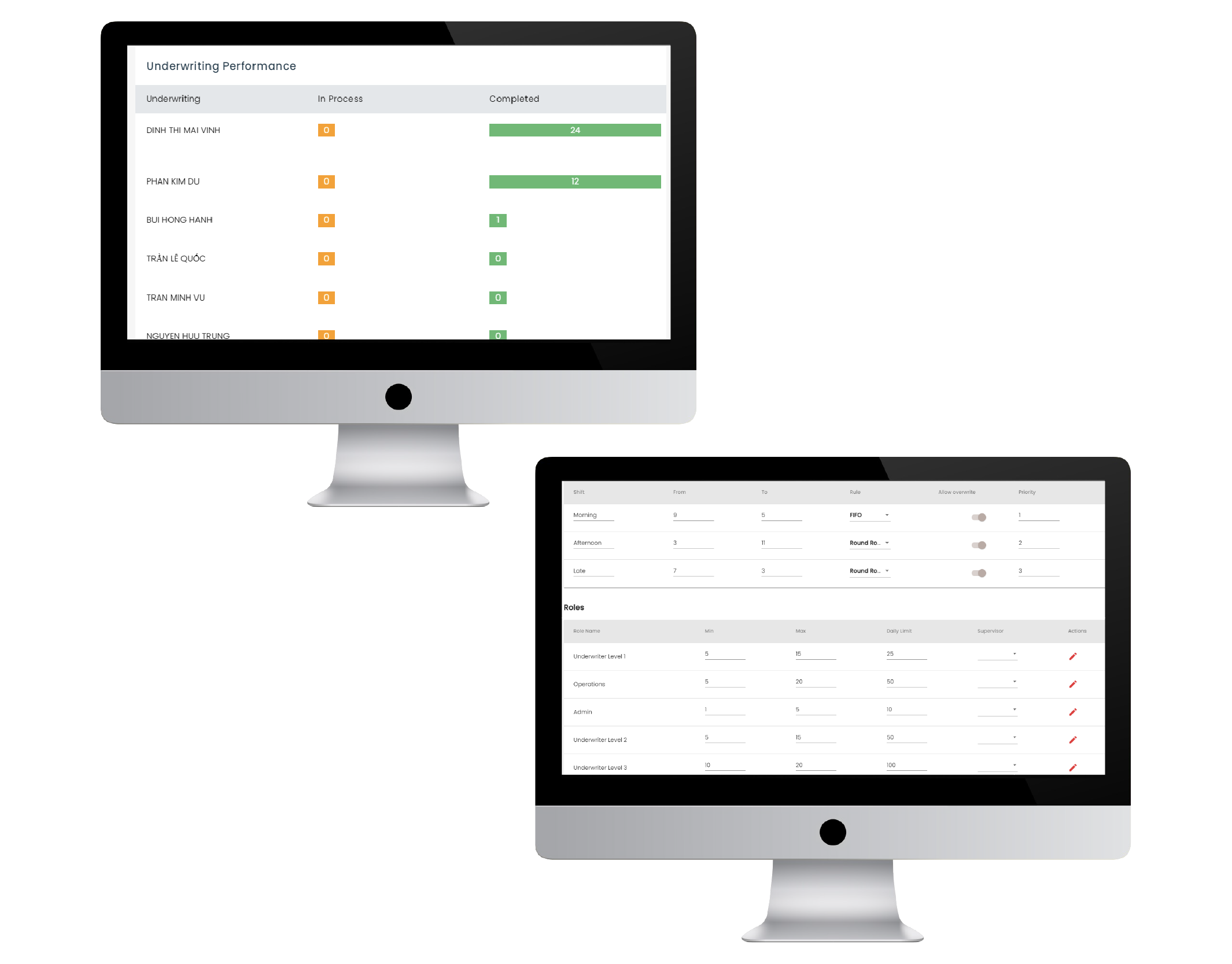

Underwriting Work Management (Vietnam)

Intelligent work management is essential in any underwriting organization to achieve the following business objectives:

- Equitable work distribution

- Specialty distribution – based on complexity and case attributes

- Decisioning authority based distribution so that the need for rework on “over authority” cases can be minimized

- Availability and workload consideration

- Fast turn around time and ability to handle variable loads

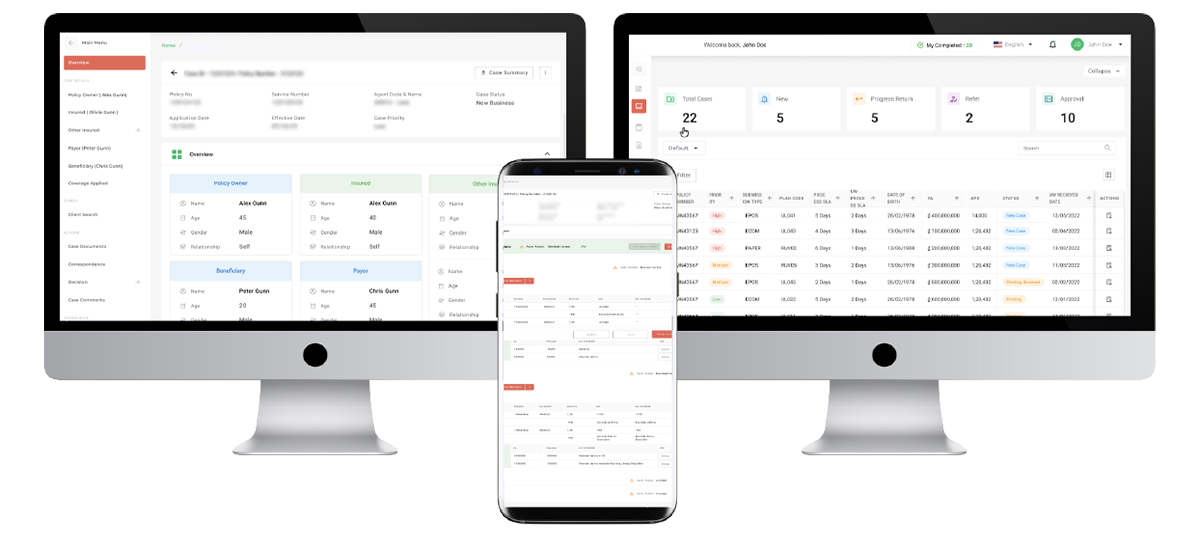

Underwriting Workbench (Vietnam)

Neutrinos’ workbench is a configurable module that adapts to the risk data and provides a 360° view of the risk to underwriters.

Workbench also enables integrations with internal and external systems relevant to underwriting – such as Policy Administration System, Claims Systems, CRM, Document Management System, Underwriting Guidelines etc., thereby as a single interaction interface for underwriting process.

Workbench adds immense value to underwriting organizations in achieving their goals of fast, accurate underwriting while maintaining lower processing costs and collaboration with cross functional teams.

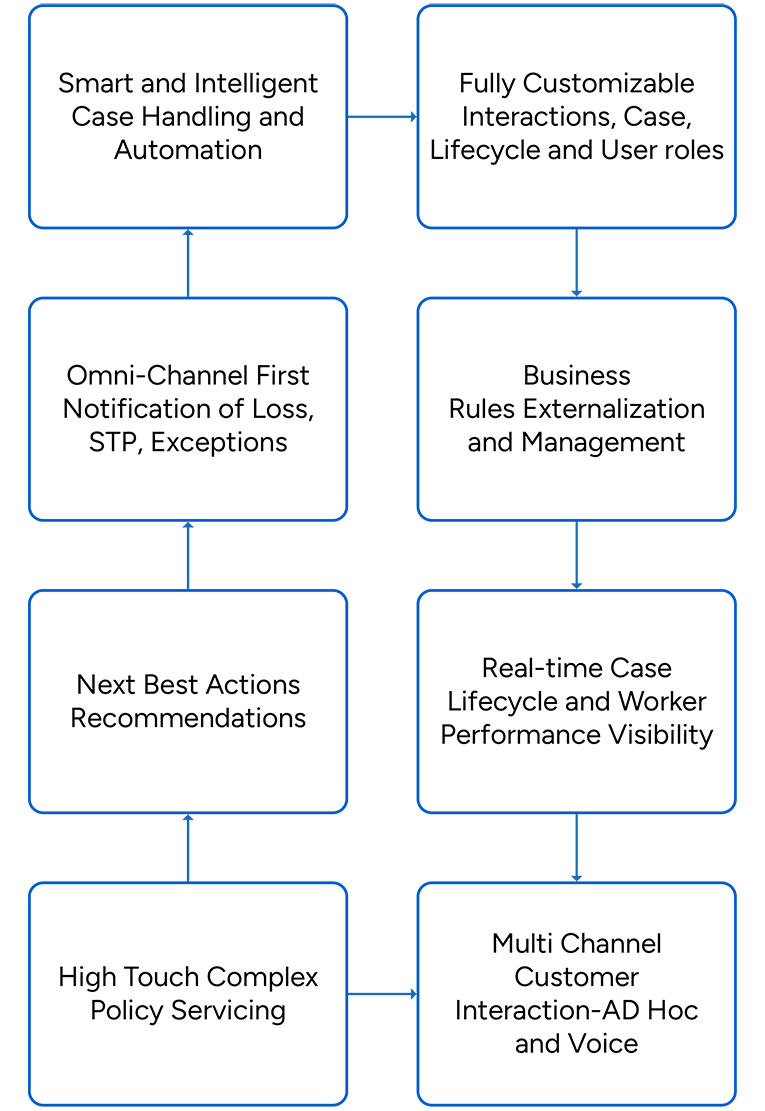

- AI: Integration to analyze the patterns of churn and help upsell customers on new products and services.

- Chatbot: Integration into custom built or 3rd party chat bots for intelligent self service.

- IVR Integration: Automatically load customer profile and once the caller is identified, and launch satisfaction surveys once the call is over.

- Case Management: Resolve cases quickly by providing agents with full context of the relevant case.

- Customer Service Agent Portal: Displaying the customer portfolio, products, & transactions for a 360° view of the customer & their satisfaction level with different touch points.

- Operations: Performing operations on behalf of the customer such as payments, transfers, setting up standard instructions.

- Complaints Management: Capturing customer complaints, following up and routing to concerned teams.

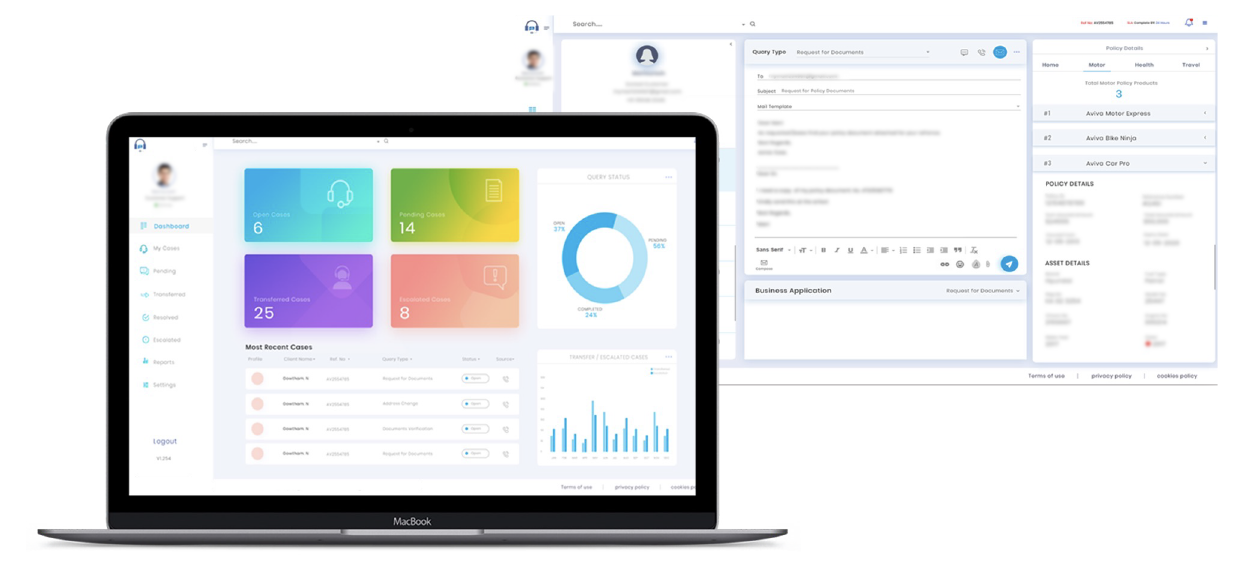

Agent Desktop for Customer Query Handling

An application developed to automatically gather customer queries coming from multiple sources, such as email, call center, social media, and WhatsApp, and to resolve those queries within a single interface interacting with all relevant back-end systems. The app was able to automatically classify the query and create a ticket, assigning it to relevant functions or departments, and provide timely assistance.

1st MVP Roll-out in 4 months

Connected Customer:

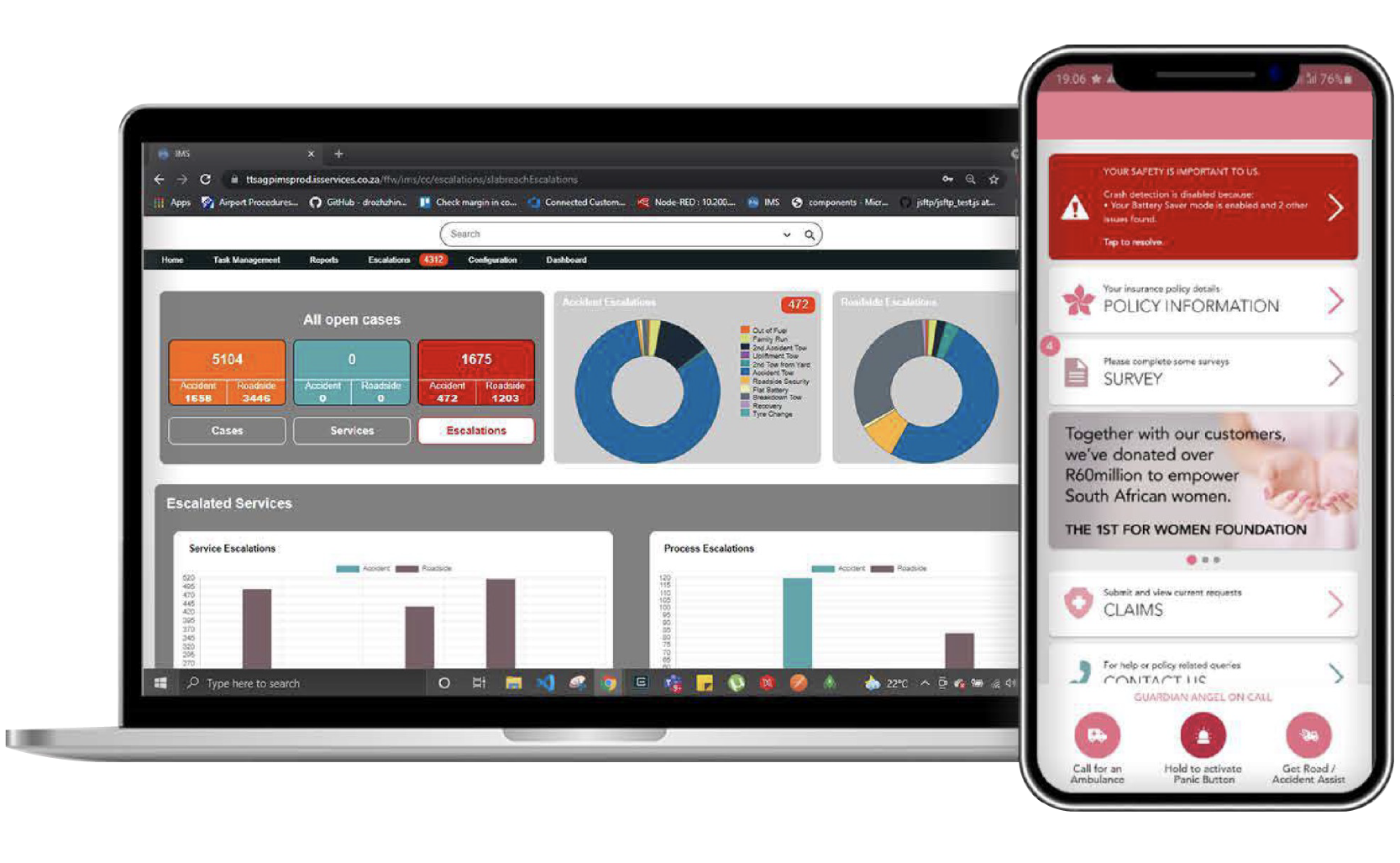

Real-time Incident Management (SA)

A Telematics solution developed to provide the insurer with a consolidated view of incident management and claims management with real-time reports to offer end-to-end visibility, fast-track the claims process, increase customer engagement & enhance customer service.

80% Customer Satisfaction

30% Claims processing time

70% Operational costs

40% Customer retention

17% Call center calls

Straight-Through Claim Processing

Automated claims processing with speed and accuracy

An end-to-end claims straight-through processing solution, implemented for a South Africa-based P&C insurer, accelerated claims turnaround from days to minutes. The intelligent, rules-based solution provides touchless processing from intake to closure.

Advantages:

- Business user-configurable rules for case classification as STP or manual adjudication.

- Intelligent multi-modal data capture collates all needed case data for accurate, comprehensive decisioning.

- Automated notifications and communications, across missing requirements, case status and payment advice.

- Massive effort savings of 50%-plus for claims operations and adjudication personnel across all claims.

- Processing cost per claim reduced by over 40%.

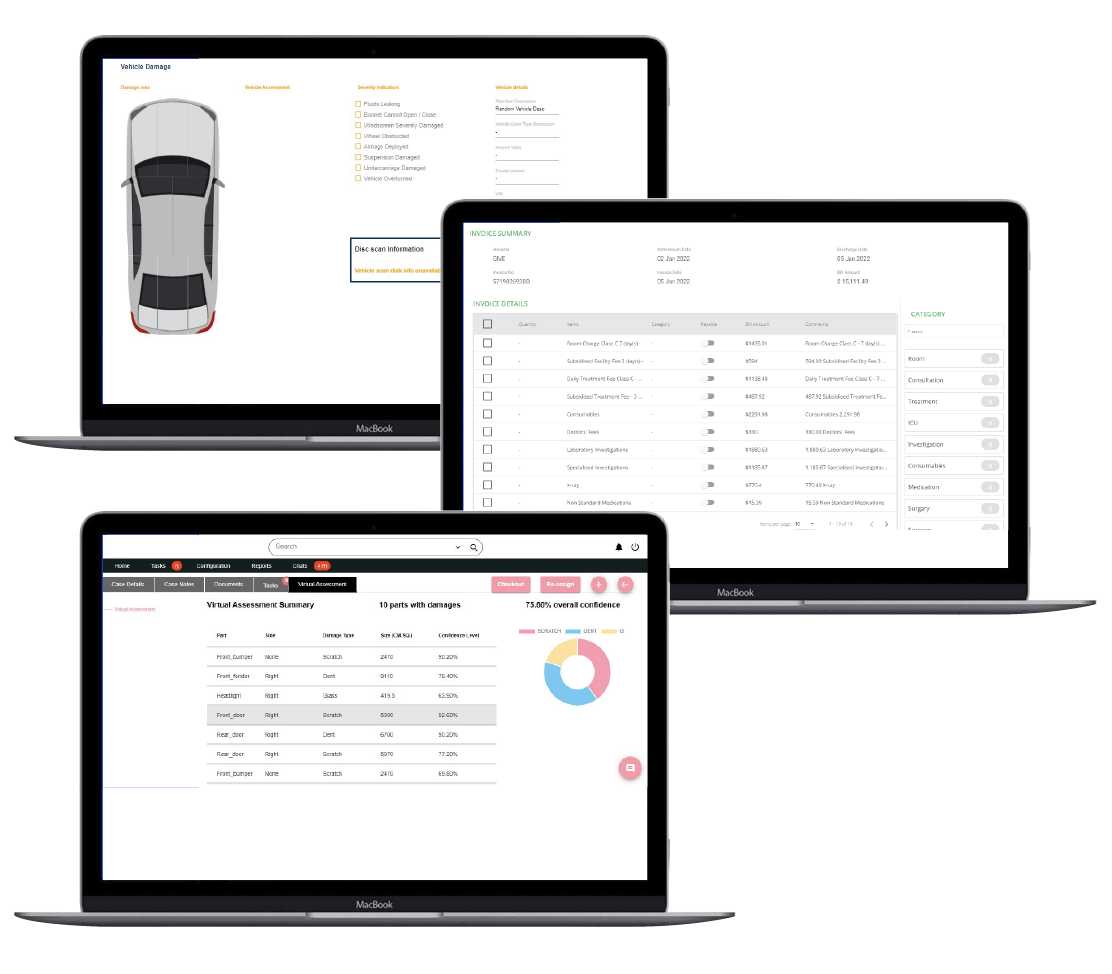

Claims Workbench

- Configurable claims workbench with 360° view. Also enables auto registration of claims using IDP based document classification and extraction of complex data such as hospital invoice and medical notes.

- Workbench comes with auto coding capability for life and health insurance claims.

- For Non life, the workbench allows object-risk visualization feature – e.g., motor vehicle damage indicator, and image/audio/video review.

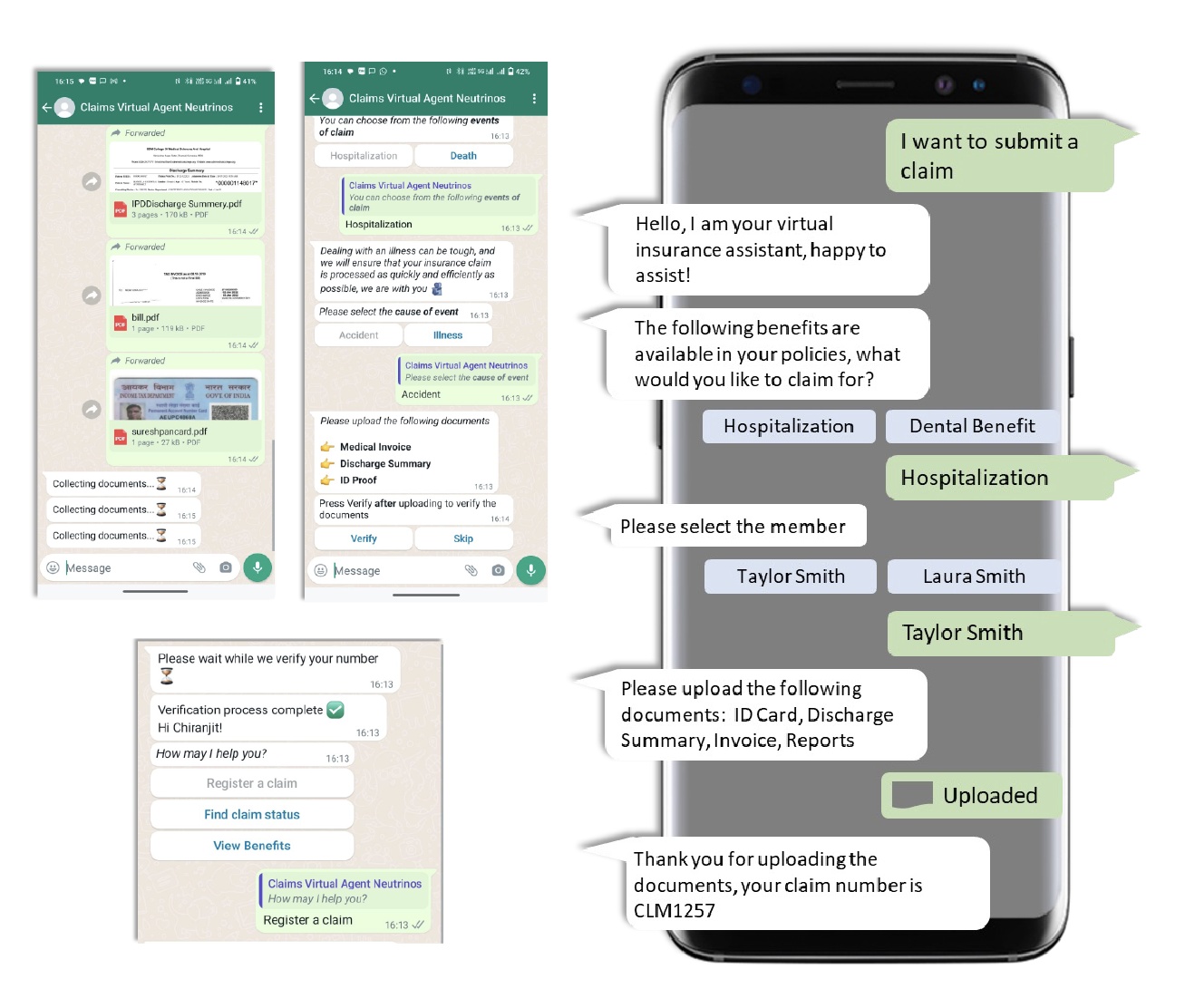

FNOL With WhatsApp Reflexive Interaction

- Customer experience is a key metric for claims organizations, and this journey begins with the first notification of loss. Enabling customers to claim through their preferred channels – Messaging, WhatsApp, Mobile App, Web.

- Simplified FNOL experience – Configurable, Guided Dialogue Flow.

- Fast and Easy document upload – drag and drop or mobile camera.

- Integrated AI driven OCR – Intelligent Document Processing that enables classification and extraction of data from documents.

- Integrated rules component to increase FTR – real time alerts for incorrect or missing documents.

What’s NEU at Neutrinos

Neutrinos launches in SA, starts training academy

Source: IT WEB

Neutrinos officially opened doors to its Johannesburg-based office – a first in Africa. The firm aims to aid the most unskilled person in application development.

A tool for those less privileged

Source: MONEYWEB

New platform is designed to shift opportunities from few to many.

Want To Design Apps? Look No Further

Source: HUFFINGTON POST

A new programme championing those excluded from the big-budget world of app design could totally revolutionise the South African tech arena.

Bootstrapped Neutrinos helps you in application development within hours

Source: YOUR STORY

The platform caters to anyone who needs to build any type of app in a unified approach (build once, test once, deploy in multiple channels of apps or devices).

Neutrinos: Enterprise- Scale Agile Solutions

Source: APAC CIO

To expedite the application development process, Neutrinos offers a pioneering low code platform that allows developers to deliver a code that works seamlessly.

Neutrinos launches Winds Of Change skills development programme

Source: HTXT

Tech evangelist company Neutrinos has launched a development programme aimed at teaching ICT skills to young South Africans.